Tunay Na Yaman

Where should you put your attention if the goal is to form the wealth suited to your desired lifestyle without relying on the status game?

Ang hirap gawin ang gusto mo kapag wala kang pera.

Sure, money can just solve your money problems.

Pero karamihan ng problema ay dahil rin naman sa pera.

This invention of money drastically changed how we define survival in comparison to our barbaric ancestors.

Mabenta sa palabas, payo ng masa, hanggang pinakadahilan kung bakit ka nag-aral at nagtatrabaho.

The abundance level you have on it dictates the amount of creativity you can produce.

Napatunayan na ng panahon ang kapangyarihan na pwede mong makuha dito.

We understand the level of acquisition, but the underlying root of producing it is unclear to the masses.

Kahit sa mismong pag-alam kung gaano karami ang kailangan para masabi na mayaman ka, lito rin.

It’s more dynamic than you think.

Binabawas Ang Sagot

The first type of argument we are focusing on understanding truths is the Deductive Argument.

Galing ang hibla nito sa pangkalahatan papunta sa tiyak na detalye.

It is based on logically certain reasoning, not just from the bounce of probability.

Ang ayos nito ay:

- Premise 1 (General Rule): All A are B

- Premise 2 (Specific Case): C is A

- Conclusion: Therefore, C is B

If the given premises are true, then the conclusion must be true.

Alam ko, parang nagiging teknikal na - bigyan kita ng halimbawa para mas luminaw:

- Premise 1: Lahat ng tao ay may pakiramdam

- Premise 2: Si Juan ay tao

- Conclusion: Samakatuwid, si Juan ay may pakiramdam

You can play the words to escape reality - like the person you know who seems nonchalant - but still, the fact is that person has feelings too.

Matagal nang pamantayan ito na panghuli sa baluktot na kaisipan.

This is the first tool in having a logical understanding in a world full of illogical sentiments.

The Wealth

Sa tagalog ay “kayamanan” mo, hindi kasama sa bilang ang hiniram o inaasahan na matatanggap.

This will clarify why a janitor can be wealthier than a doctor, depending on how and where they allocate their earnings.

Pasok ito kahit magsimula ka man sa wala, tinatrabaho mo na, o nasa bandang tuktok na ang bilang ng mayroon sa bulsa.

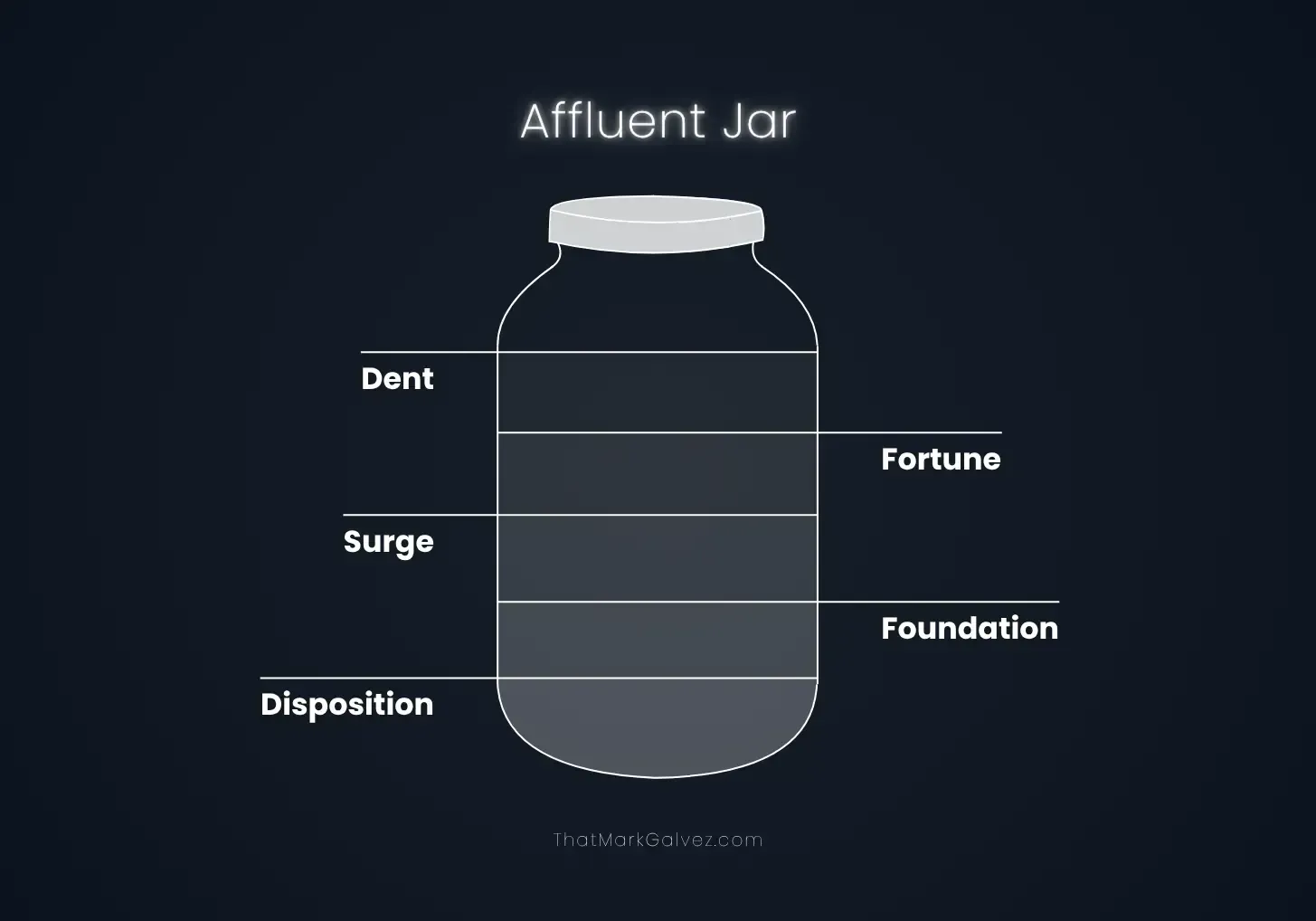

I call this the Affluent Jar.

Base ito sa libro kong, DOFF (Dots Of Financial Freedom), na pangkalahatan ang atake.

It’s the formation of points as a reference that you (and I) can look at from time to time:

1. Disposition

- Seeing is not believing.

- Nasa nabibilang ang bilang.

- Open to various classifications.

- Alam at abot mo ang naglilimita.

- Lean towards the positive-sum game outcome.

2. Foundation

- Swerte ang lumapit.

- Defining the structure.

- Kabig ng asal ang karamihan.

- Revolving around economics.

- Partikular na kaalaman ang pinakapondo.

3. Surge

- The work.

- Source of income.

- Pagdaloy ng pera sa’yo.

- Proper play of debt as leverage.

- Lumulobo ang halaga sa buhay at salapi.

4. Fortune

- Intentional saving.

- Pagbili ng kumpyansa.

- Protection from insurance.

- Paglago ng mayroon sa pamumuhunan.

- Distribution of accumulated values through the Estate Plan.

5. Dent

- Tutok sa ari-arian.

- Iteration over repetition.

- Pagtuklas ng magpapadali.

- Accountability with corresponding equity.

- Tanggapin na talo kapag madali kang umayaw.

We evolved from pessimistic tendencies, where those who assumed greater risk were more likely to survive than those who were overly optimistic.

Sa kasalukuyang lipunan, ‘di na gano’n kapanganib dahil sa pag-unlad sa kung paano ginagawa ang mga bagay-bagay.

The poorest person in the world right now is comparatively richer than the hunter-gatherer tribes of the past.

Pagpwesto sa mga gawaing mas malaki ang resulta ay kritikal kumpara sa dati.

I simplified wealth itself for you - though it’s not necessarily easy - so there’s no need to make it complicated.

Anong mas panalong galaw para sa’yo?

Choose the tasks that feel like a fun game to you but seem like necessary work to others.

Ipwesto mo ‘yon sa kung anong mabenta sa merkado.

- Mark Galvez